- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Why High Yield Bonds Could Benefit Portfolios in 2024

The potential for a slowing economy this year could spark equity volatility. High yields bonds may help investors manage that risk.

- Volatility & Risk

- Fixed Income Insights

- High Yield Strategy

- Risk Management

Key Points

What it is

We examine how trends in the U.S. high yield bond market this year could produce attractive returns and diversification benefits.

Why it matters

U.S. economic growth likely will slow this year, possibly sparking equity volatility. High yield bonds may help investors manage risk.

Where it's going

High yield bonds, with elevated yields and an historical tendency to outperform equities amid volatility, may help investors reduce risk this year.

In 2024, we expect the U.S. economy to slow, which could spark some volatility in the equity market. As a way to help investors manage portfolio risk while earning income, high yield bonds merit a look. When stock markets slide, high yield bonds historically have outperformed equities on average, similar to the diversification benefits other types of bonds provide. However, strong credit quality, a benign outlook and elevated yields make high yield bonds especially attractive now and potentially enhance those diversification benefits.

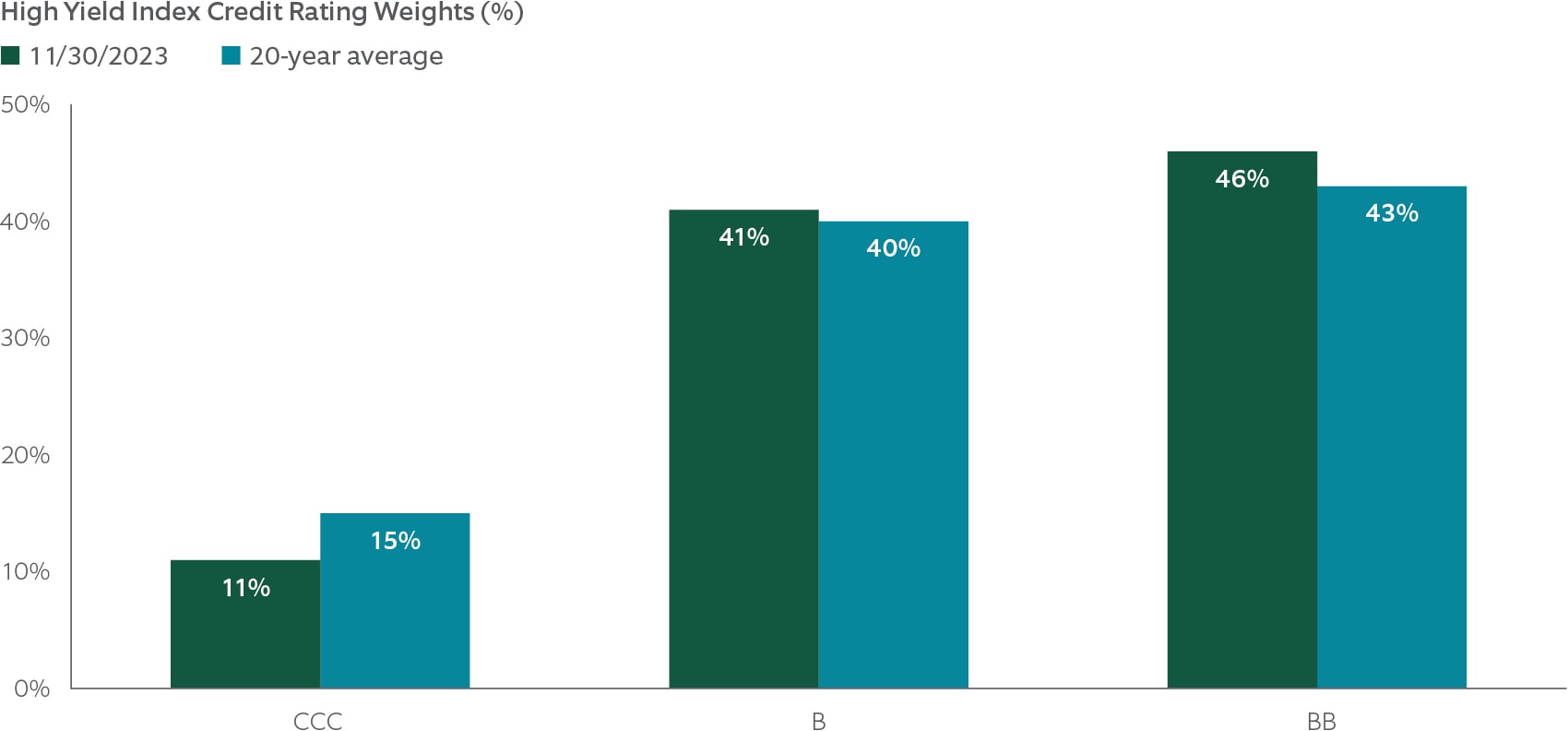

The quality of bonds in high yield market has notably increased, as BB- and B-rated issuers comprise 87% of the asset class, above the 20-year average of 83% (Exhibit 1). High yield issuers generally have become larger and more diversified, improving their ability to weather economic adversity. Tight lending standards and elevated interest costs are likely to keep debt level growth low for companies, as debt has become an expensive way to run a business. This helps to keep the leverage, and in turn default risk, from growing substantially. We expect default rates to be range-bound around the long-term average of 3% to 4%.

Default risk is the probability that a bond issuer can't make full and timely payments of contractually obligated principal and interest.

EXHIBIT 1: High Yield Credit Quality at Historically High Level

Compared to its 20-year average, the credit quality of the high yield market was relatively high as of November 2023, with BB- and B-rated issuers comprising 87% of the asset class. This may help limit risk of defaults.

Source: Bloomberg, as of November 30, 2023

Set Up for Solid Performance

Our outlook should support total return, a combination of price appreciation and yield. We see potential for price appreciation this year because as interest rates fall, which we expect this year, bond prices generally gain. Conversely, prices fall when rates rise. The rising rates of the past two years lowered the prices of high yield bonds, setting them up for notable price appreciation if rates fall this year with expectations of the start of Federal Reserve rate cuts.

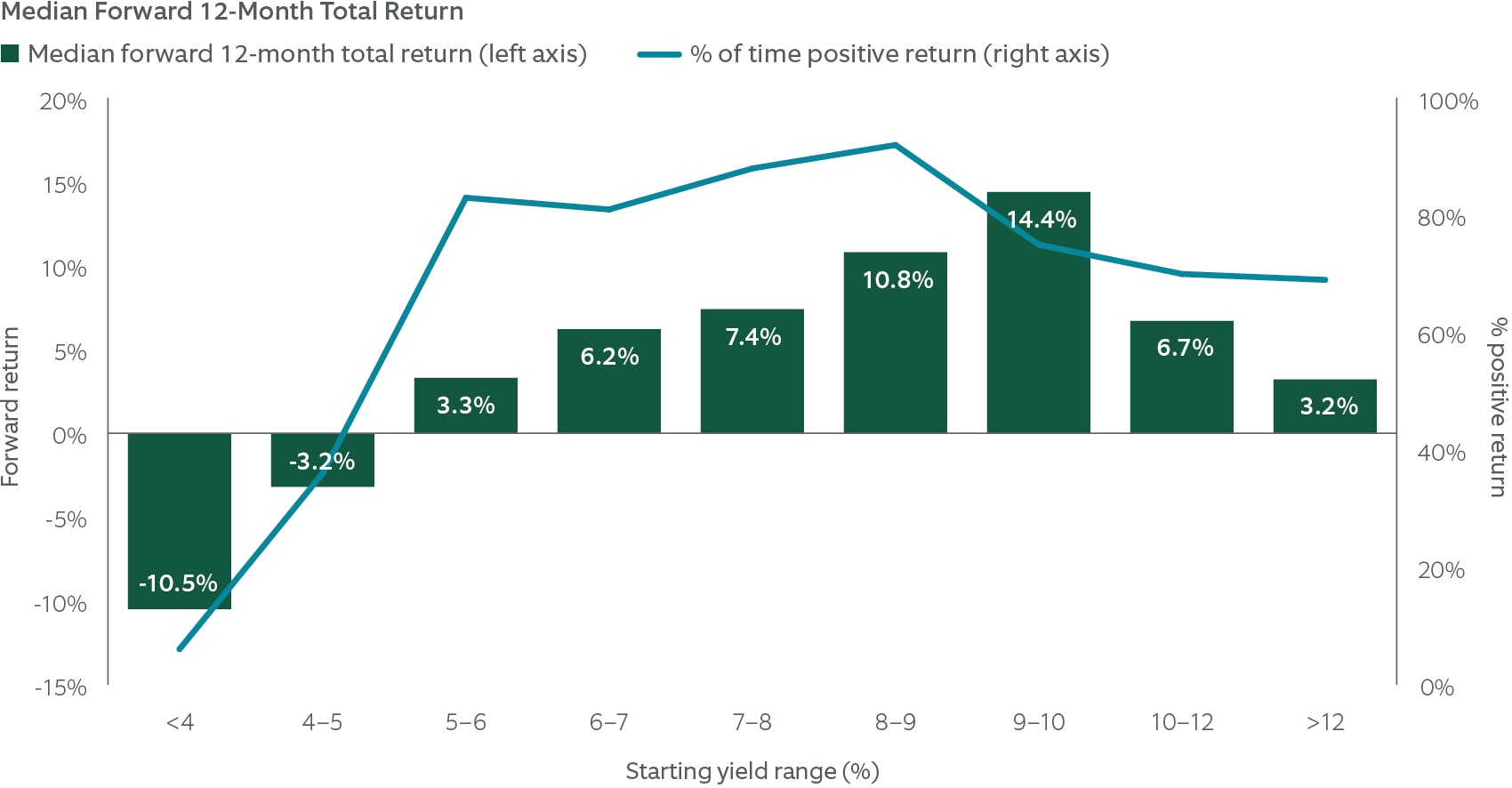

In terms of yields, the elevated yields today not only enhance returns, they also historically have correlated with strong future performance within certain ranges, as shown in Exhibit 2. Based on data going back to 2000, high yield bonds with yields of 7% to 8%, the range we’re seeing now, have produced a median return of 7.4% a year later with positive returns 88% of the time. Generally, high yield bonds with yields from 6% to 10% represented the sweet spot for year-forward returns in this analysis.

EXHIBIT 2: The Historical 'Sweet Spot' for Yields

High yield bonds with yields of 7% to 8%, the range we’re seeing now, have produced a median return of 7.4% a year later with positive returns 88% of the time. Generally, high yield bonds with yields from 6% to 10% represented the sweet spot for year-forward returns in this analysis.

Sources: Bloomberg, Barclays Research. Data from January 2000 through November 2023.

The Maturity Wall Risk

A risk that some see looming over the high yield market is the increasing amount of debt maturing for high yield issuers in the coming years, often called a “maturity wall”. When debt comes due, companies usually must refinance the debt by issuing new high yield bonds. Companies that are refinancing debt now usually are paying more interest than the maturing debt issued years ago at much lower rates.

The concern is that the significantly higher interest costs may increase the risk of default. However, we think the higher quality issuers now can absorb higher interest costs, even if rates don’t fall, given their increased scale and ability to deliver productivity gains and earnings growth. If rates fall as we expect this year, the jump in interest costs likely will be less dramatic for companies who refinance after 2024.

An Attractive Market Backdrop

A less hawkish Federal Reserve and improving fundamentals should continue to support the high yield market. Also, a benign default outlook provides an attractive backdrop for elevated yields. Under these market conditions, we think investors can find value in the portfolio diversification benefits of , in particular if equity volatility strikes amid a slowing economy.

Main Point

Promising Outlook for High Yield

The potential for a slowing economy in 2024 poses challenges for investors. High yield bonds look attractive because of stable fundamentals, a benign default outlook and a history of outperforming stocks when the stock market falls.

Contact Us

Interested in learning more about our expertise and how we can help?

IMPORTANT INFORMATION

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTI or its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTI or its affiliates’ efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTI or its affiliates. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2a of the Form ADV or consult an NTI representative.

Forward-looking statements and assumptions are NTI or its affiliates’ current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing, and other services rendered to various proprietary and third-party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee